Cap-and-trade proposed as market mechanism to slash carbon emissions. Air quality commission says not now.

by Allen Best

Curtis Rueter works for Noble Energy, one of Colorado’s major oil and gas producers, and is a Republican. That makes him a political minority among the members of the Colorado Air Quality Control Commission, of which he is chairman.

In his voting, Rueter, who lives in Westminster, tends a bit more conservative than his fellow commission members from Boulder County. But on the issue of whether to move forward with a process that could have yielded carbon pricing in Colorado, he expressed some sympathy.

“I am generally in favor of market-based mechanisms, so it’s a little hard to walk away from that,” he said. at the commission’s meeting on Feb. 19. But like nearly all the others on the commission, Rueter said he was persuaded that there were just too many fundamental questions about cap-and-trade system for the AQCC to embrace at this time. Only Boulder County’s Jana Milford dissented in the 7-1 vote. Even Elise Jones, until recently a Boulder County commissioner, voted no.

Just as important as the final vote may have been the advance testimony. It broke down largely along environmental vs. business lines.

Western Resource Advocates, Boulder County, and Colorado Communities for a Climate Action testified in favor of the cap-and-trade proposal.

From the business side came opposition from Xcel Energy, The Denver Metro Chamber of Commerce and allied chambers from Grand Junction to Fort Collins to Aurora, and, in a 7-page letter, the Colorado Oil and Gas Association.

Most businesses echoed what Gov. Jared Polis said in a letter: “While a carbon pricing program may be one of many tools that should be considered in the future as part of state efforts to achieve our goals, our assessment of state level cap and trade programs implemented in other jurisdictions is that they are costly to administer, exceptionally complicated, risk shifting more pollution to communities that already bear the brunt of poor environmental quality, have high risk for unintended consequences, and are not as effective at driving actual emissions reductions as more targeted, sector-specific efforts,” Polis wrote.

This is from Big Pivots, an e-magazine tracking the energy and water transitions in Colorado and beyond. Subscribe at bigpivots.com

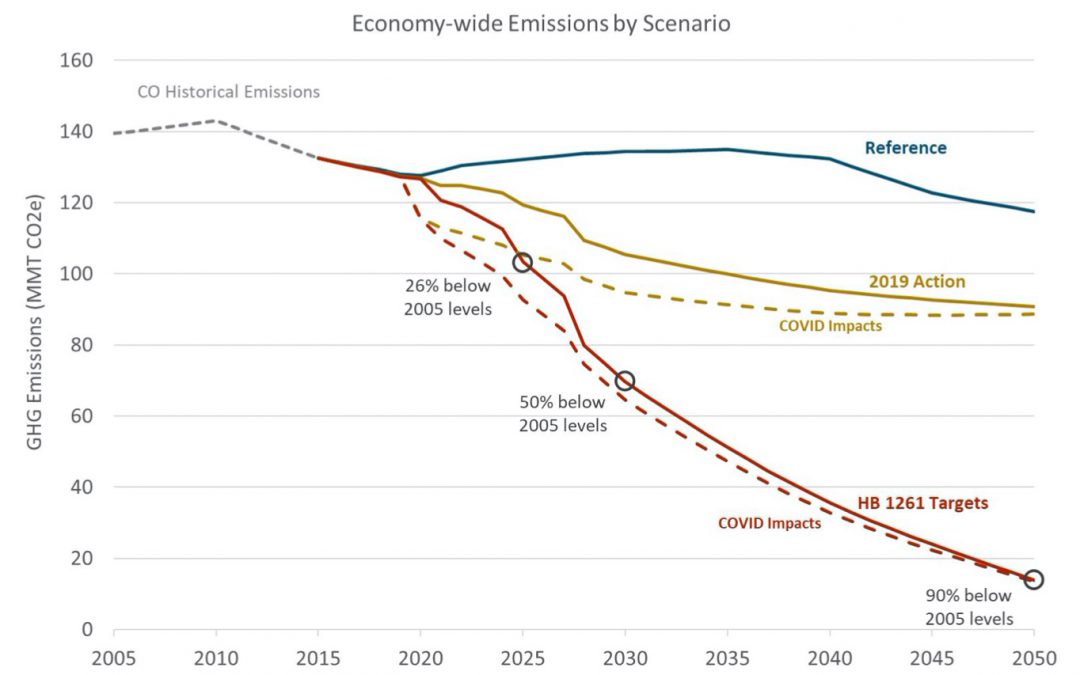

The cap-and-trade proposal came from the Environmental Defense Fund. EDF has been saying for a year that Colorado has been moving too slowly to decarbonize following the 2019 passage of the landmark SB-1261. The law requires 50% decarbonization by 2030 and 90% by 2050.

What does a 50% reduction look like over the course of the next 9 years? Think in terms of ski slopes, and not the dark blue of intermediates or even the ego-boosting single-black-diamond runs at Vail or Snowmass. Not even the mogul-laden Outhouse at Winter Park or Senior’s at Telluride.

Instead, think of the serious steeps of Silverton Mountain, where an avalanche beacon is de rigueur.

Can Colorado, a novice at carbon reduction, navigate down this Silverton Mountain-type carbon reduction slope by 2030?

Colorado, says EDF and Western Resource Advocates, needs a backstop, a more sweeping mechanism to ensure the state hits these carbon reduction goals.

California has had cap-and-trade for years, and a similar device has been used among New England states to nudge reductions from the power sector. The European Union also has cap-and-trade.

Following the May 2019 signing of Colorado’s carbon-reduction law, H.B. 19-1261, the Polis administration set out to create an emissions inventory, then began structuring a sector-by-sector approach. For example, the Air Quality Control Commission has conducted lengthy rule-making processes leading up to adoption of regulations in several areas.

Hydrofluorocarbons, a potent greenhouse gas used in refrigeration, are being tamped down. Emissions from the oil-and gas-sector are being squeezed. The commission this year will direct its attention to proposed rules that result in fewer emissions from transportation.

Meanwhile, the state has set out to hurry along the state’s electrical utilities from their coal-based foundations to renewables and a small amount of new gas. The utilities representing 99% of the state’s electrical sales have agreed to reduce emissions 80% by 2030 as compared to 2005 levels. Only one of those commitments, that of Xcel Energy, has the force of law. Others fall under the heading of clean energy plans. But state officials think that utilities likely will decarbonize electricity even more rapidly than their current commitments. That 80% is a bottom, not a top.

Will Toor, director of the Colorado Energy Office, presented to the Air Quality Control Commission an update on the state’s roadmap. The document released in mid-January runs 276 pages, but Toor boiled it down to 19 slides, which nonetheless took him 60 minutes to explain. It was a rich explanation.

Toor explained that Colorado needs to reduce emissions by 70 million tons annually. The Polis administration thinks it can achieve close to half of the reductions it needs to meet its 2030 target by 2030 through the retirement of coal plants and associated coal mines. Those reductions alone will yield 32.3 million tons annually.

The oil and gas sector should yield a reduction of 13 million tons, according to the state’s roadmap. That process had taken a step forward the previous day when the Air Quality Control Commission adopted regulations that tighten the requirements to minimize emissions from pneumatic controllers. Later this year, the AQCC will take up more proposed regulations.

Replacement of internal-combustion technology in transportation will yield 13 million tons. The Polis administration foresees deep reductions in transportation, partly through an incentives-based approach, even if not it’s not clear what all the components of the strategy look like.

Near-term actions in buildings, both residential and commercial, and in industrial fuel use can yield another 5 million tons annual reduction.

Waste reduction—methane from coal mines, landfills, sewage treatment plants, and improved recycling—will nick another 7.5 million tons annually More speculative are the strategies designed to reduce emission from natural and working lands by 1 million tons.

Add it all up and the state still doesn’t know how it will get all of the way to the 2030 target, let alone its 2050 goal of 90% reduction. Toor and other state officials, however, have expressed confidence that the roadmap can get Colorado far down the road to the decarbonization destination and is skeptical that cap-and-trade will.

“I don’t know that the record supports that they guarantee a true pathway toward reductions of emissions.”

In contrast, the roadmap has identified “highly enforceable strategies” to achieve reduction of 58 to 59 million of the 70 million tons needed by 2030, he said.

Some actions depend upon new legislation, perhaps this year and in succeeding years.

In the building sector, for example, the Polis administration sees “very interesting opportunities” with a bill being introduced into the legislature this year that would give gas-distribution companies targets in carbon reduction while working with their customers. See, “Colorado’s legislative climate & energy landscape.”

“This isn’t something that we are going to solve through just this year’s legislative session and this and next year’s regulatory actions,” said Toor. He cited many potential pathways, including hydrogen, but also, beyond 2030, the potential for cost-effective carbon capture and sequestration.

Later in the day, Pam Kiely and Thomas Bloomfield made the Environmental Defense Fund’s case for cap and trade. They described a more significant gap between known actions and the targets, a greater uncertainty about hitting the targets that they argued would best be addressed by giving power and other economic sectors allocation of allowances, which can then best be moved around to achieve reductions in cost-effective ways.

One example of cap-and-trade actually involves Colorado. The project is at Somerset, where several funding sources were pooled to pay for harnessing of methane emissions from the Elk Creek Mine to produce electricity. The Aspen Skiing Co. paid a premium for the electricity, and Holy Cross Energy added financial incentives. But a portion of the money that has gone to the developer, Vessels Coal Gas Co., is money from California’s cap-and-trade market

Kiely said Colorado’s 2019 law directed the Air Quality Control Commission to consider the greatest and most cost-effective emissions reductions available through program design. That, she said, was explicit authority for creating a cap-and-trade program.

“We think it’s a relatively light (legal) lift,” said Bloomfield. “You have authority to charge for those emissions.”

Further, Kiely said, cap-and-trade will most effectively achieve reductions in emissions and will do so faster than the state’s current approach. It will deliver a consistent economic signal and be the most adaptable. “The program does not have to predict where the optimal reduction opportunities will be a year from now without information about the relative cost of pollution control technologies, turnover rates in vehicles and other key uncertainties,” she said.

Then the questions came in. Kiely rebutted Toor’s charge of ineffectiveness. The most telling criticism of the California program was that the price was too low, she said.

What defeated the proposal—at least for now—were questions about its legality. Colorado’s Tabor limits revenues, and commission members were mostly of the opinion that their authority revenue-raising authority needed to be explored in depth.

Garry Kaufman, director of the Air Pollution Control Division, said that doing the work to rev up for a cap-and-trade program would require a “massive increase in the division’s staff,” north of 40 to 50 new employees, and the division does not have state funding.

He and others also contended that pursuing cap-and-trade would siphon work from the existing roadmap.

Then there was the sentiment that for a program of this size, the commission really did need direct legislative authority.

Commissioner Martha Rudolph said that in her prior position as director of environmental programs at the Colorado Department of Public Health & Environment, she had favored cap-and-trade. Not now, because of the legal, resource, and timing issues.

Elise Jones, the former Boulder County commissioner, voted no, but not without stressing the need to keep the conversation going, which is what will happen in a subcommittee meeting within the next few years.

“This is not now, not never,” said Rueter of the vote. This is conversation that will come up again, maybe at the federal level or maybe in Colorado a few years down the road.”

This is from Big Pivots, an e-magazine tracking the energy and water transitions in Colorado and beyond. Subscribe at bigpivots.com

Why support Big Pivots?

You need and value solid climate change reporting, and also the energy & water transitions in Colorado. Because you know that strong research underlies solid journalism, and research times take.

Plus, you want to help small media, and Big Pivots is a 501(c)3 non-profit.

Big grants would be great, but they’re rare for small media. To survive, Big Pivots needs your support. Think about how big pivots occur. They start at the grassroots. That’s why you should support Big Pivots. Because Big Pivots has influence in Colorado, and Colorado matters in the national conversation.

- How much water remains in southeast Colorado’s aquifers? - April 18, 2024

- Keeping water rights on the Yampa while utilities figure out future technologies - April 18, 2024

- How can Colorado add this much renewable energy by 2040? - April 18, 2024