Xcel files plan for 14 projects that would collectively provide 4,900 megawatts of new electrical generation

by Allen Best

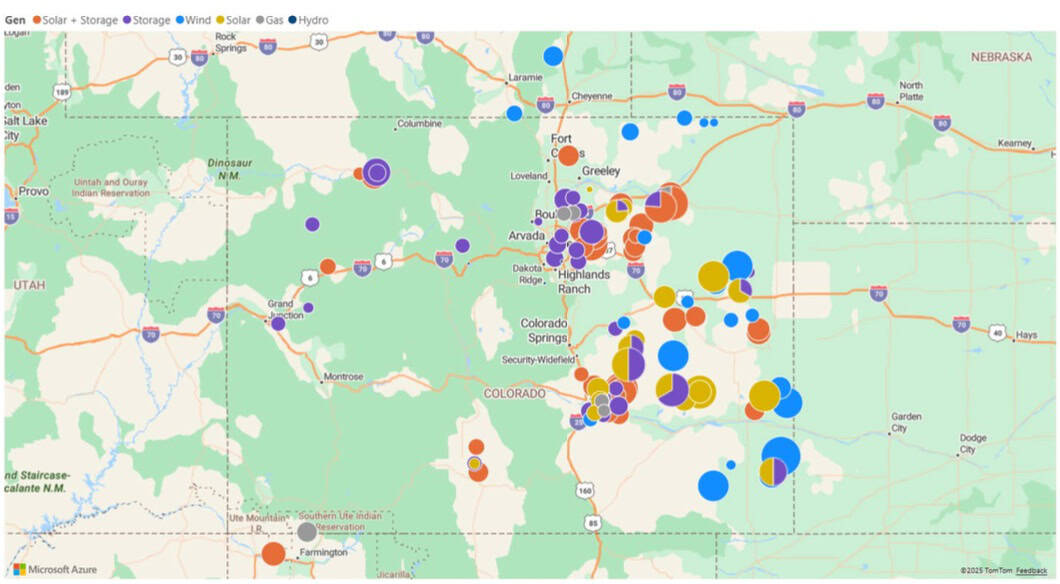

It’s an elephant, this Xcel Energy filing with the Colorado Public Utilities Commission. The hurried RSP yielded 161 bids from 49 bidders for renewable energy and storage projects along with several natural gas plants.

Xcel culled these proposals to produce 14 A-list projects. If they come to fruition — and that is an upper-case IF — those projects would capture nearly $5 billion in tax credit benefits on a net-present-value basis, the utility told the Colorado Public Utilities Commission in filings on Dec. 5.

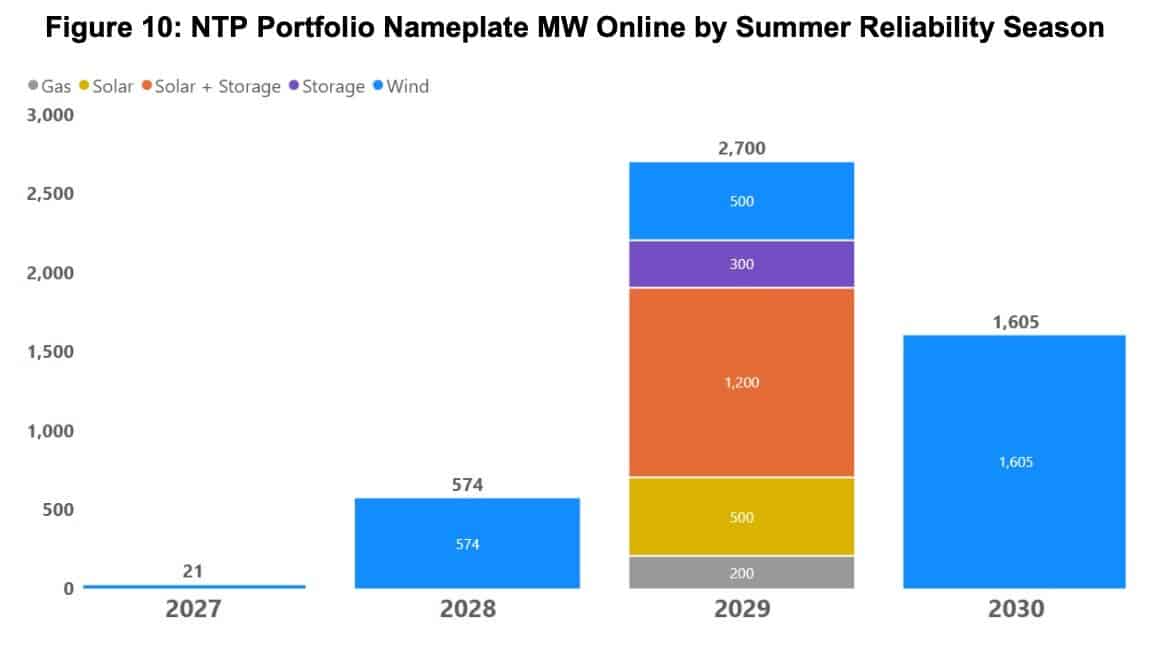

Those same projects would deliver 4,902 megawatts of additional capacity, nearly all of it before the summer heat of 2029. Of this generating capacity, 1,199 would be classified as “firm.”

The resource mix in what is called the near-term procurement are as follows:

- wind, 2,702 MW.

- solar, 500 MW

- hybrid solar, 600 MW

- hybrid storage, 600 MW

- standalone storage, 300 MW

- natural gas, 200 MW

This list of projects was based on balance of competitive pricing, acceptable development risk, interconnection feasibility, system-level impacts and priority locations.

Xcel wanted to get projects in just transition communities, i.e. places where coal plants will be closed or converted, and those that avoid what it calls the Denver Metro Constraint. What that means is that just as with driving cars, things get congested in the metro area. The utility also emphasized the geographic diversity of the projects, at least within the context of eastern Colorado.

Taking note of emerging financial, supply chain and other issues, Xcel also identified a second tier of 14 backup projects.

Almost certain to produce heartburn is the location of the various projects. Or rather, where they are not.

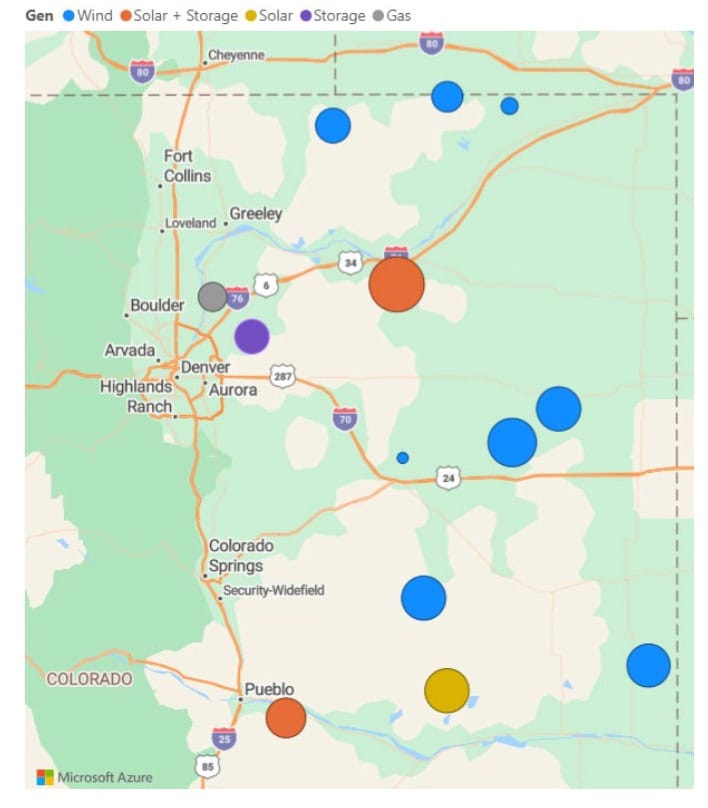

This map gives a general idea of the location of the 14 projects in the A-list identified by Xcel Energy. The top map shows locations of projects bid by companies in Colorado and adjoining areas.

All the top-tier projects are east of Interstate 25. Only one is in Pueblo County, a 500-acre solar project southeast of Pueblo. The Comanche Generating Station lies in Pueblo, and the county government, now represented by former PUC commissioner Frances Koncilja, has been particularly demanding that Pueblo get replacement jobs and tax base as the coal plants close.

Pueblo County already has almost 900 megawatts of solar generating capacity, more than half immediately adjacent to Comanche. Solar provides low-cost power but not necessarily high-paying jobs and the same heft in tax base. Xcel has been paying $25 million a year in property taxes in Pueblo County.

In a report issued in January 2024, Pueblo County said it wanted a nuclear power plant or, failing that grandiose ambition, at least a natural gas plant.

Xcel says the natural gas plant proposed in Pueblo County came up short.

“To be sure, these projects can support economic development and provide property tax benefits for a community impacted by coal plant retirements,” the company said in its filing. “Nevertheless, at this time, the risks outweigh the benefits, particularly given the company’s resource adequacy position and concerns. Key issues included high capital costs and uncertainty around access to firm gas supply given the current pipeline infrastructure in the Pueblo area. For that reason, only one Pueblo-area thermal project advanced into more detailed evaluation.”

Instead of Pueblo County, the top candidate for natural gas is northeast of Denver, somewhere in the in Weld County, near Fort Lupton. This location also provides easier transmission into the metropolitan area than transmission from the south.

Routt County, home to the Hayden Generating Station, comes up even shorter. It has nothing on the A-list of 14 projects.

However, backup projects in both Pueblo and Routt counties have been identified. A 400-megawatt storage project has been identified for Routt County. A 400-megawatt solar-plus-storage project in Pueblo County also made the B list.

Morgan County — site of the Pawnee coal plant near Brush — also makes the A-list with 800 megawatts of solar and storage capacity in Xcel’s preferred portfolio. It also has projects in the backup portfolio. Plus, Pawnee will lose its coal capacity but is being converted to natural gas generation.

It’s not surprising that Xcel’s first-tier projects all lie east of I-25. That’s not necessarily surprising. Colorado’s best wind blows there. And the Great Plains have the most accessible locations for building solar. Too, Xcel is well along the way toward completion of its $1.7 billion Colorado Power Pathway. The 345-kilovolt transmission line will sweep around eastern Colorado for 550 miles, in one segment paralleling the Kansas border, to deliver electricity primarily to the metro area.

Transmission exists from both Hayden and Craig, in northwestern Colorado, where fivecoal- burning units will be retired in a little more than three years. How that transmission capacity will be used once the coal plants go down in 2028 is not clear. In the case of Craig, however, Tri-State Generation and Transmission Association plans to build a 307-megawatt natural gas plant. It is also commissioning a solar project south of Craig.

Xcel also discusses the constraints of transmission into metropolitan Denver from the south. The utility is still trying to figure out how to get expanded transmission capacity from Colorado Springs to metro Denver. The PUC will be taking public input on Tuesday evening from 5 to 7 p.m. in Kiowa, 50 miles southeast of downtown Denver, at the Elbert County Fairgrounds.

The hurry-hurry of this near-term procurement was triggered by the One Big Beautiful Bill Act signed by President Donald Trump on July 4th with rollback of federal production and investment tax credits for wind and solar energy. To take full advantage of existing tax credits, construction must be underway by July 2026.

Colorado Gov. Jared Polis on Aug. 1 issued a letter that called for a rapid effort to prioritize deployment of clean energy projects. This triggered a joint filing by Xcel and several state agencies on Aug. 22 to initiate the expedited schedule. The PUC order of Sept 8 further specified deadlines of Oct. 6 for the RFP responses and Dec. 5, for Xcel’s evaluation. By Feb. 9, The PUC commissioners expect to have a written decision.

Also of note:

- Bids received by Xcel ranged from $19.26 per MWh to $116.23 MWh.

- Wind came in at lowest cost, $20/MWh to $43/MWh, while solar came in at approximately $37/MWh, in both cases on the basis of levelized energy costs. However, there were far more solar projects proposed than wind.

- Five of the nine first-tier projects in are expansions of existing wind farms or repowering of existing farms. They fall below the median price of $42.75 per MWh. Those projects constitute 619 MW of the total 2,702 MW of wind.

- The document notes that several projects on the short list lie in Sand Creek Massacre and Amache Internment Camp National Historic Sites’ viewsheds. Developers would have to work with the appropriate parties. It also noted that one bid failed, in part, because of “multiple unresolved environmental and permitting risks, including lack of wildlife consultation for species of concern, such as lesser prairie chickens.”

- Another issue is whether new wind turbines would reduce production from existing turbines. And the document notes an “emerging concern” that certain brands of batteries may have national security concerns vis-à-vis embedded communications protocols that may advantage certain “foreign entities of concern.” No prohibitions exist on specific vendors, but that may change over time and cause projects to shut down.

- Commissioners in Kiowa County, meeting in Eads during September, adopted regulations governing renewable energy generation. Two of the projects, one wind and one solar, are included in this portfolio.

- The PUC commissioners’ decision Sept. 8 noted that Holy Cross Energy and Xcel Energy had apparently reached agreement on the rights of Holy Cross to acquired projects in this solicitation.

- Was this climate alarmism? - December 18, 2025

- Another step on the Ark River - December 18, 2025

- A conversation with Jonathan Overpeck - December 17, 2025

NUCLEAR!

Where will the necessary water come from for any of these projects?

Since when is water needed for wind, solar and natural gas plants??

OK. Something(s) tangible!

As far as Pueblo and gas, I was looking at a map of gas storage and there isn’t any down there. With increasing variable renewables, a new gas plant is likely to operate intermittently, and I think that kind of plant there would need to either or both reserve 100s of miles of pipeline or be dependent on volatile spot market prices. Maybe that’s why Pueblo gets charged so much for power from the BHE gas plant there. Big storage in or near Morgan County.

As far as Craig/Moffat and Hayden/Routt, I just travelled up there and on the way stopped at the site of a denied solar farm near Craig and an in-limbo, probably not to be permitted one a few miles from Hayden. These were both under the ginormous transmission lines and around old O&G pads. Rolling hills w/some grass or wheat and only a few neighbors. IMHO, about as reasonable as sites for solar farms can get. So if the West Slope is going to make it this difficult to site solar, then I have no sympathy if they get left behind. (CO might make these facilities a bit more attractive to County Commissioners if the tax assessment rate didn’t decline each year by 5%. The output does not.)

Finally, hopefully the wind turbines near the historic sites will be equipped with lights-out tech, not just the dimming required by CO law. And hopefully concerned parties won’t be swayed by misleading renderings of looming turbines using unrealistic zoom/telephoto lens perspectives, which was part of the campaign against Lava Ridge wind farm, with respect to the Japanese internment camp site nine miles away.